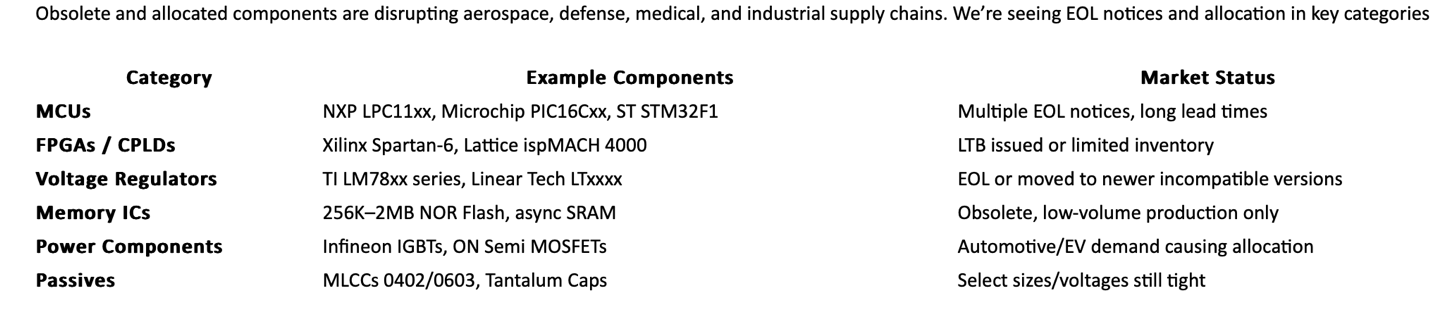

A shortage of End-of-Life (EOL) board level electronic components could potentially affect aerospace and defense projects worldwide, with critical shortages of microcontrollers, FPGAs, Power ICs, and Memory ICs threatening operational readiness.

Recent industry data, highlighting obsolescence trends, reveals alarming declines: Microchip’s PIC16C series, now EOL since 2018, faces a 70% supply drop; STMicroelectronics’ STM32F1, discontinued in 2020, is down 65%; Xilinx’s Spartan-6 FPGA, EOL since 2019, has seen a 60% reduction; and Lattice FPGAs, phased out in 2021, are down 55%. This crisis, exacerbated by allocation issues, risks equipment failures in military and medical applications, where untested components could prove disastrous.

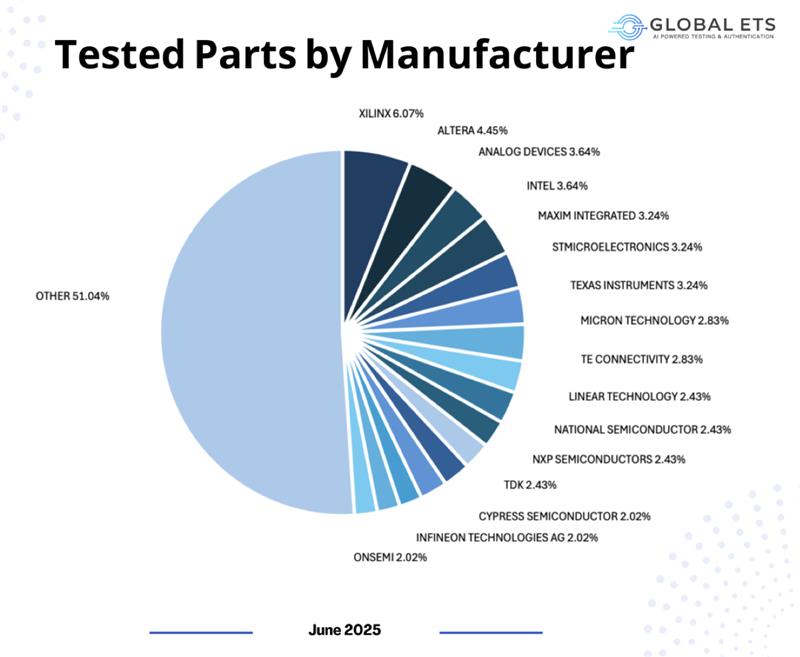

The figures, based on 2025 supply chain assessments, underscore the market status: PIC16C, once a staple in legacy avionics, now commands premium prices on gray markets due to scarcity; STM32F1, widely used in defense systems, is increasingly unavailable, pushing engineers to risky alternatives; Spartan-6, critical for radar processing, faces a dwindling pool of authentic stock; and Lattice FPGAs, vital for industrial controls, are nearing exhaustion. EOL notices from manufacturers like Texas Instruments (legacy regulators) and Analog Devices (memory ICs) have triggered a 40-50% supply contraction since 2023, according to industry reports. This bottleneck—fueled by rapid tech evolution and geopolitical supply chain strain—has contributed to a 15% counterfeit rate among unverified parts, according to recent Global ETS testing, significantly increasing the risk of failure in mission-critical systems.

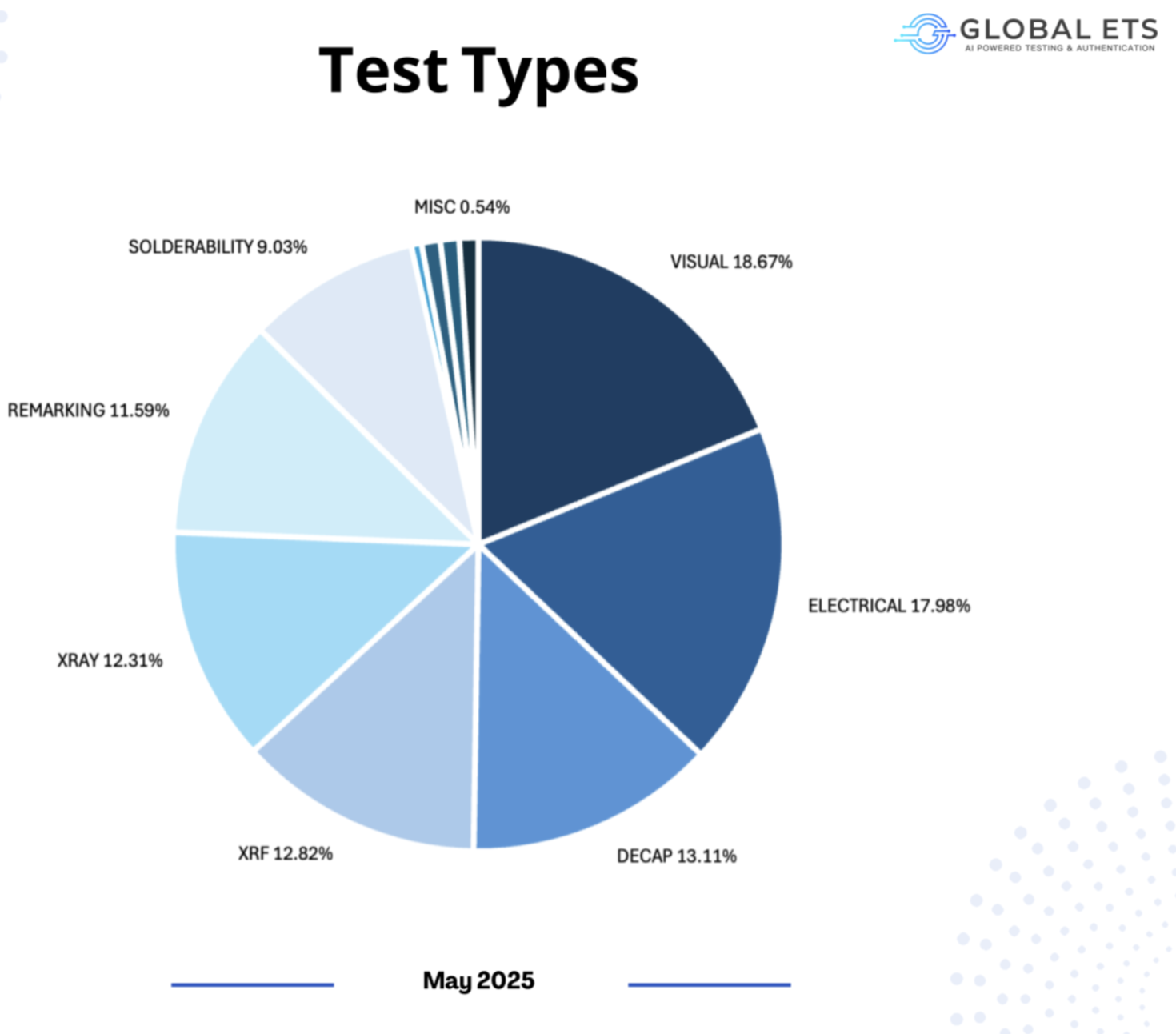

“The implications are stark,” says Honest Components President Jackie Schwab. “Untested or counterfeit components, often mislabeled or recycled, can malfunction under stress, potentially causing aircraft navigation errors or medical device failures. To address this Honest Components conducts factual testing of all board-level components through Global ETS, an AS6081 and ISO/IEC 17025 accredited lab, using X-ray and decapsulation methods to verify authenticity.

This process, detailed in Global ETS’ 2025 risk assessment, identified the 15% counterfeit prevalence, aligning with military concerns about spare part integrity. While certification is not mandatory, such testing exposes the dangers of inferior products flooding the market, where gray market sourcing has surged 30% year-over-year.

Schwab adds that industry experts warn that the shortage could delay $50 billion in aerospace contracts by 2026, with defense programs like the F-35 facing component delays. Medical sectors, reliant on stable Memory ICs for imaging devices, report a 20% increase in procurement costs.

“The crisis has prompted calls for regulatory action, with the U.S. Department of Defense flagging counterfeit risks in its 2025 supply chain review. Meanwhile, brands like NXP and ON Semiconductor, with partially EOL Power ICs, are scrambling to ramp up legacy production, though output lags demand by 40%. This situation underscores an urgent need for authenticated sourcing to mitigate risks as global demand for electronics in autonomous vehicles and defense tech continues to rise. Data suggest that affected sectors could face a 10% production cut by year-end,” Ms Schwab notes. END